Quant job question interview: Derivation of the most common non-arbitrage condition

- Price of vanilla European and American options versus strike price is a convex function;

- Condition is model- and maturity-independent;

Eh.. what´s up docs? A common question in quant job interviews regards the derivation of a non-arbitrage condition which determines that the price of a vanilla options is a convex function of the strike price. This convexity is quite important, for instance, in the calibration of implied volatility surfaces. A related question is listed in the chapter 2 of the well-known Joshi, Denson & Downes book (Quant job interview, published by Pilot Whale press). In this post, I´ll present the prove of this non-arbitrage condition.

Starting

with the simplest case of Europeans. The

key in proving this condition as well as in the analysis of several other aspects

of financial derivatives is in the creation of an appropriate portfolio. In

this case, we choose a portfolio with three calls with the same maturity T: $C_1(k_1), C_2(k_2), C_3(k_3)$ with strike prices $k_1<k_2<k_3$ . The portfolio consists of a long position with y units of $C_1$ , a short position with a unit of $C_2$, and a long position with $(1-y)$ units of $C_3$. If one desires to

prove this condition for put option prices the same configuration of portfolio can be

used. The initial value of the portfolio is:

$x(t)=yC_1(t)-C_2(t)+(1-y)C_3(t)$

We study the payoff of this portfolio at maturity for different

values of the asset S at T:

$S<k_1\to x(T)=0 $

$k_1<S<k_2\to x(T)=y(S-k_1)$

$k_2<S<k_3\to x(T)=y(S-k_1)-(S-k_2)$

$k_3<S \to x(T)=y(S-k_1)-(S-k_2)+(S-k_3)$

We can now define a value for y by making the portfolio worth equal zero

when $S>k_3$ at maturity. In this case, $y=(k_3-k_2)/(k_3-k_1)$

$S<k_1\to x(T)=0 $

$k_1<S<k_2\to x(T)=(S-k_1)(k_3-k_2)/(k_3-k_1)$

$k_2<S<k_3\to x(T)=(k_3-k_2)(S-k_1)/(k_3-k_1)-(S-k_2)$

$k_3<S \to x(T)=0$

For European options, we can safely use the martingale property of

the risk-neutral measure for pricing the arbitrage-free portfolio:

$x(t)=e^{-r(T-t)}E[x(T)|F(t)]$

where E[.] is the expected value and F(t) denotes a filtration. Without

risk for the generality of the derivation process, we assume a constant

interest rate r. We will replace the expressions of the portfolio in order to

obtain a relation for the three initial call prices:

$yC_1(t)-C_2(t)+(1-y)C_3(t)=e^{-r(T-t)}E[x(T)|F(t)]$

which can be rearranged as:

$C_2(t)=yC_1(t)+(1-y)C_3(t)-e^{-r(T-t)}E[x(T)|F(t)]$ (1)

$C_2(t)=yC_1(t)+(1-y)C_3(t)-e^{-r(T-t)}E[x(T)|F(t)]$ (1)

Now it is

just a matter of interpretation of the expression above. First, we use that $0<y<1$ in order to identify that the two first terms in the right hand side of

equation denotes a line passing through the prices of $C_1$ and $C_3$. Second, the

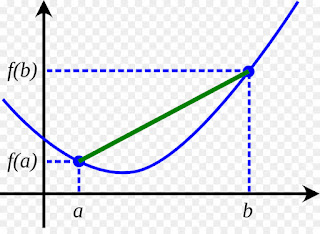

expected value of x(T) is positive. Therefore, the price of $C_2$ can only be either under or at the line defined by $C_1$ and $C_3$. This characteristic denotes a convex

function as we wanted to demonstrated, as indicated in the figure below:

It is worth mentioning that in the derivation of this non-arbitrage condition, there is no mention to any particular stochastic model describing the dynamics of the asset or any other factor. Only the martingale property under the risk neutral measure is explored. This is an important consequence! Consider, for instance, that one is pricing an asset with a mean reverting characteristic that is modelled as a Ornstein-Uhlenbeck process instead of a geometric brownian motion. Even so, the convexity of the vanilla European options will hold. In addition, this non-arbitrage condition does not depends on the maturity.

So, can one say that this convexity relation holds if the asset is american? Well, let me start this discussion remembering that american options are supermartingales under the risk-neutral measure, that is, for a put for instance we have:

$p(t) \geq \frac{1}{D(t)}E[D(T)max(K-S,0)|F(t)]$

So, can one say that this convexity relation holds if the asset is american? Well, let me start this discussion remembering that american options are supermartingales under the risk-neutral measure, that is, for a put for instance we have:

$p(t) \geq \frac{1}{D(t)}E[D(T)max(K-S,0)|F(t)]$

where $D(t)$ is the discount function. The supermartingale feature of the american options comes from the fact that the holder will exercise the option as soon as its value for immediate exercise is greater than the present value of the payoff at maturity. In this sense, american options give more right to the holder therefore has a larger value.

If we replace the inequality for american options in the expression (1) above, we obtain:

$C_2(t)\leq yC_1(t)+(1-y)C_3(t)-e^{-r(T-t)}E[x(T)|F(t)]$ (2)If we replace the inequality for american options in the expression (1) above, we obtain:

Therefore, the non-arbitrage condition related to the convexity of the option price as a function of the strike price also holds for vanilla American options.

That´s all folks! May the force be with you.

#=================================

Diogo de Moura Pedroso

LinkedIn: www.linkedin.com/in/diogomourapedroso

Comments

Post a Comment